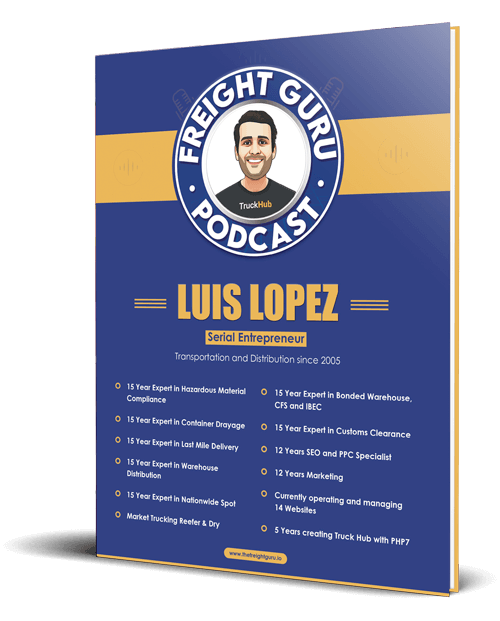

In episode 27 of the Freight Guru, Luis Lopez talks about the top mistakes he made when starting his transportation business about two decades ago.

Listen to the Full Episode Here

As a small to mid-sized fleet owner, Luis empathizes with similar fleet owners just starting out struggling with a lack of experience. These six tips are essential for a smooth start.

Cash Flow

Having three to six months of cash reserved in your bank account will help you long term when asking for a letter or line of credit.

“The main thing my banker wants to see when I ask for an equipment loan or a larger line of credit, or a Letter of Credit for a lease… is a cash flow report,” said Luis.

Therefore, having an organized cash reporting method is important. When you’re starting and don’t have an accountant hired, you might want to outsource to a freelance CPA on Fiverr or Upwork.

Another option is to start logging your reports on QuickBooks until you’re able to hire an accountant.

To keep your expenses organized, we recommend separating your bank accounts, one for savings and another for operations.

Stay on track of your spending and revenue streams with monthly, quarterly, and yearly cash flow reports.

“75 percent to 85 percent of revenue, depending on the mode of transport and if you lease or own equipment, will [lead to monthly or weekly expenses],” said Luis. “…to see a lot of money coming in but, also a lot of money coming out will lead to a massive problem very quickly and can cause debt,” he continued.

When you have control over your finances and know where you stand, you can build your budget accordingly to reinvest back into your business and equipment maximizing efficiency. “These are the types of conversations you need to be having during your operations meetings,” said Luis.

Rates per mile

Calculating the rate per mile can be tricky if you don’t know which variables to consider.

As a fleet owner, Luis checks his fixed and variable expenses monthly in order to calculate his rate per mile.

An effective way to calculate your rate per mile is to separate your fixed costs from your variable costs.

Then, compare your monthly variable expense reports to average out a proper rate.

Fixed expenses: are costs that do not change with an increase or decrease in the number of goods or services produced or sold. Fixed costs are expenses that have to be paid by a company, independent of any specific business activities.

Variable expenses: are corporate expenses that change in proportion to how much a company produces or sells. Variable costs increase or decrease depending on a company’s production or sales volume.

Variable expenses examples are:

- Tractor fuel

- Reefer fuel

- Emergency Maintenance

- Leased or owned equipment

Whether you lease or buy your equipment will make a noticeable difference on your variable expense reports. In a previous podcast episode, “Buying vs. Leasing Trucks,” Luis recommended leasing equipment over owning it.

“Yet in the current market, I am wrong. Owning equipment makes a lot of sense because of many factors, including inflation…used truck sales are up approximately 30-40 percent,” said Luis.

Related article: Episode 26 – How Inflation Is Affecting Shipping Rates In 2021

Depending on the scale of your fleet and company, leasing and running trucks is more cost-effective and is reflected on your expense reports every month.

Taking all this into consideration, when you know what your rate per mile is, you are able to negotiate contractual rates or spot market deals with brokers and forwarders.

Take a listen to these past episodes to set yourself up for success in the trucking industry:

Episode 21: How To Generate 10k In Revenue On The Spot Market Using DAT Load Board Pt. 1

Episode 22: How To Generate 10k In Revenue On The Spot Market With DAT Load Board Pt. 2

Deadhead

When you’re calculating the rate per mile, you need to consider the trip as two; one trip for pick up and the other for delivery.

That being said, it would be a major “money pit” if you don’t factor in deadheading inside your rate per mile.

Deadhead: are the number of miles the driver is driving empty from getting from their last delivery location to the next pick-up location.

“Probably one of my biggest mistakes was calculating rate per mile without calculating deadhead,” said Luis. “if you do not add those empty miles to your loaded miles, then when you average out the gross revenue of what the load is paying it’s not an accurate rate per mile being paid,” he continued.

A common mistake new fleet owners make is looking and chasing for the highest paying loads, which we’ve discussed on previous podcasts, especially on the spot market using DAT.

“For multiple years, I focused on creating the most amount of revenue…by doing that, I would normally run the highest deadhead miles, a very inefficient way to run trucks. Because…the more empty miles you run, the less amount of time your driver has to run the ELD within the legal limits per day,” explained Luis.

Choosing efficient loads that pay well and give your driver consistency, using brokers you have a relationship with is the most efficient way to run your trucks. Because you are choosing loads based on trust and that will give your driver’s job security, increasing retention.

Related article: Episode 25 – 5 Ways To Overcome Driver Shortages In 2021

Truck Parking

Fifteen years ago, owning land for truck parking or a truck yard would have made more sense since the capital needed for this investment, as well as most demands and regulations, had a low barrier for entry.

“I had multiple opportunities to buy truck parking, and I always decided to rent because I never knew the size of my fleet if it was going to grow or get smaller…I didn’t understand the value of truck parking, and most of it was ignorance, and it’s probably one of the biggest mistakes I’ve made in business,” said Luis.

Nowadays, truck parking is being forced out of most cities, especially major cities across the United States.

Because of this ongoing situation, fleet owners need to beautify their truck parking, which is costly.

“So you’re seeing these trucking owners [selling] their land to REITs that can afford to do truck parking,” said Luis.

Real estate investment trusts (REITs): Congress established REITs in 1960 to allow individual investors to invest in large-scale, income-producing real estate.

REITs are buying truck parking almost 30 percent above market value inflating the prices, making it more difficult for fleet owners to buy land.

Then, they rent out the parking at about $7,000 an acre, or they rent out the individual parking spaces at around $400 per 53-foot position plus a tractor-trailer.

Solution

The most cost-effective way to buy and maintain land for truck parking is through a loan or SBA program, especially if you occupy the space.

“The government has great SBA programs for small businesses where you only have to put 10 percent down to get a loan… we’re looking at that as a way of actually owning truck parking space, but it’s still very difficult…” said Luis.

Some of the parking maintenance requirements include:

- Beautification

- Irrigation (you must hold a certain percentage of your water in your truck parking space)

- Paving

- Lighting (For security purposes)

Extra Resources:

Truck parking shortage worsens; new study notes systems issues

Commentary: Is truck parking really that big of a problem?

Economy of Scale

The Economy of Scale is a term used to lower a trucking company’s average cost per mile by allowing them to procure yearly contracts with companies like Pilot for fuel or discount on mobile tire repairs if they would only use Loves.

This is especially beneficial if you’re doing container drayage or over-the-road trucking where you need to procure fuel in larger volumes.

“For example purchasing fuel, you want to reach out to your reps and try to get the best discount possible based on the number of gallons of fuel you’re consuming every week,” said Luis.

Compliance

DOT compliance and safety measures are essential to operating your trucking business legally and successfully.

“The onboarding, safety, drug testing, randoms and all that, go with having a DOT number.”

Having an unsatisfactory DOT number prevents you from booking with top brokers and tarnishes your reputation for future negotiations.

Best compliance practices you can implement now:

- Trust your driver onboarding and compliance to a third-party company that will take care of the drug testing during the hiring process.

- Work on ELD audits for 30 minutes a day or you will feel overwhelmed.

- Focus on safety every day to avoid missing something.

Micromanaging

“The first step to learning not to be a micromanager is realizing that you micromanage people,” said Luis.

Hiring the right people for your team is essential and trusting that they can perform at 110 percent with minimal supervision.

“People nowadays don’t like to be micromanaged, especially as Covid has evolved a lot of people are working remotely,” said Luis.

Communicating with your team is a healthy way to work with them to exploit their potential.

As a micromanager, you want to make your team aware and let them know the tasks that are personal to you and will handle yourself.

Delegate tasks and realize that you are one person that cannot manage all tasks of your business.

Recommended Logistics and Trucking companies:

FTL Services – http://teamdgd.com – https://goftl.io – https://gologistics.io

LTL Services – https://goltl.io

Hazmat Services – https://gohazmat.io

TMS – https://mytruckhub.com

Logistics Services – https://go-freight.io

Fulfillment – https://gosunship.io

Warehousing – https://gowarehouse.io